The New DeFi Boom Starting is evident as Aave and Uniswap achieve historic milestones, fueled by Ethereum’s (ETH) surge past $2,500. On May 14, 2025, Aave reported a record $25 billion TVL, while Uniswap crossed $3 trillion in total trading volume. These achievements, coupled with active whale movements, signal a potential renaissance for decentralized finance (DeFi). This article examines the catalysts behind this surge, its market implications, and whether DeFi is poised for sustained growth.

Aave’s Dominance in DeFi Liquidity

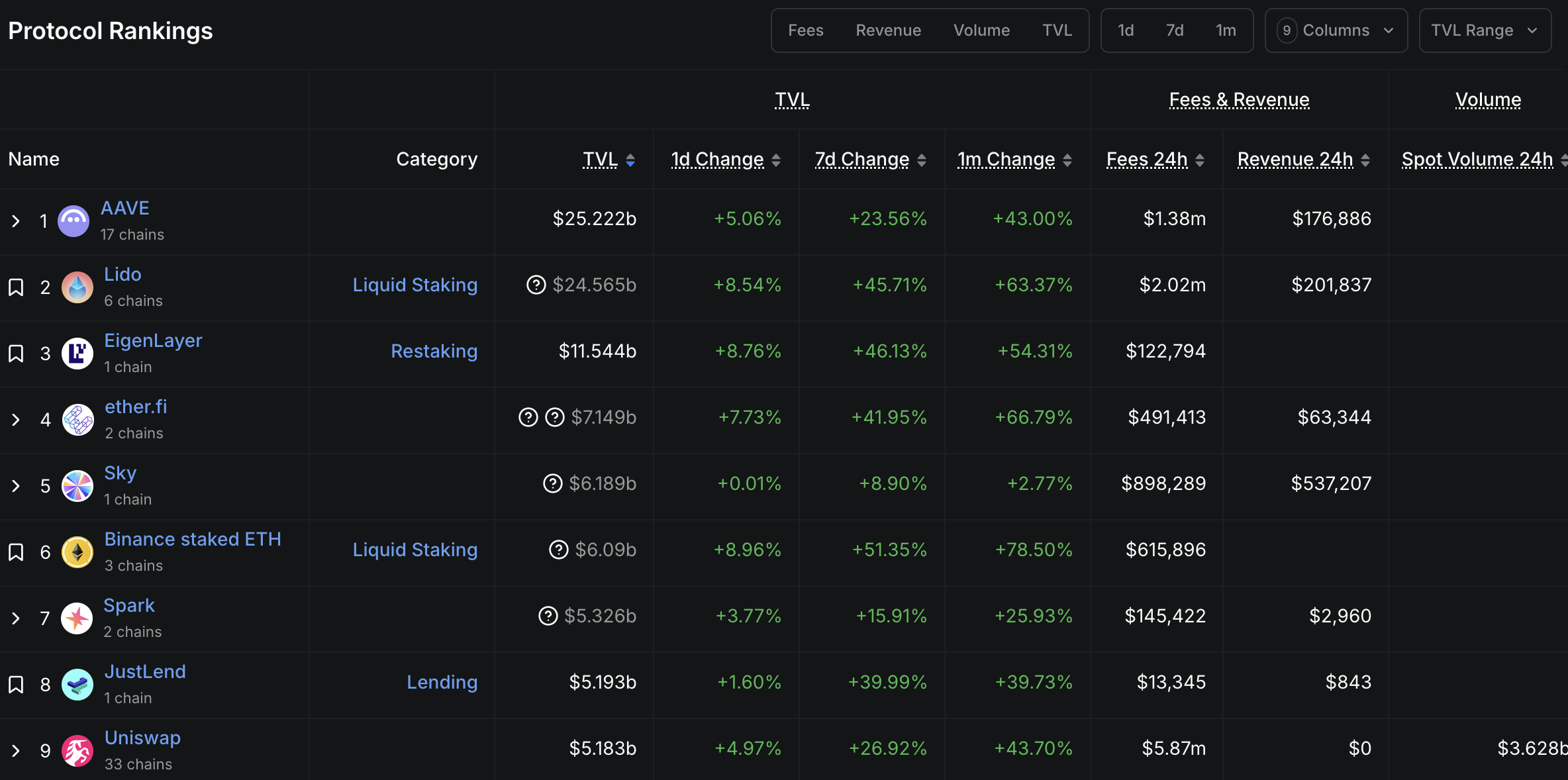

Aave TVL ranking. Source: DefilLama

The New DeFi Boom Starting is underscored by Aave’s unprecedented $25 billion TVL, announced by founder Stani Kulechov on May 11, 2025. Capturing 21% of the DeFi market’s total value locked, Aave outpaces competitors like Lido and EigenLayer. This growth reflects large investors depositing significant assets into Aave’s lending and borrowing protocol, driven by confidence in ETH’s rally above $2,500.

Whale activity further highlights this momentum. A wallet linked to WLFI deposited 50 WBTC into Aave V3, borrowing 400 million USDC to acquire 1,590 WETH at $2,515, holding a $15.11 million position with a healthy 2.0 health rate. Another whale, nemorino.eth, purchased 3,088 WETH at $2,488, securing a $124,000 unrealized profit. These moves signal bullish sentiment, though not all whales agree—on May 12, one borrowed 5,000 ETH from Aave and shorted it at $2,491, reflecting divergent strategies.

Uniswap’s Trading Volume Milestone

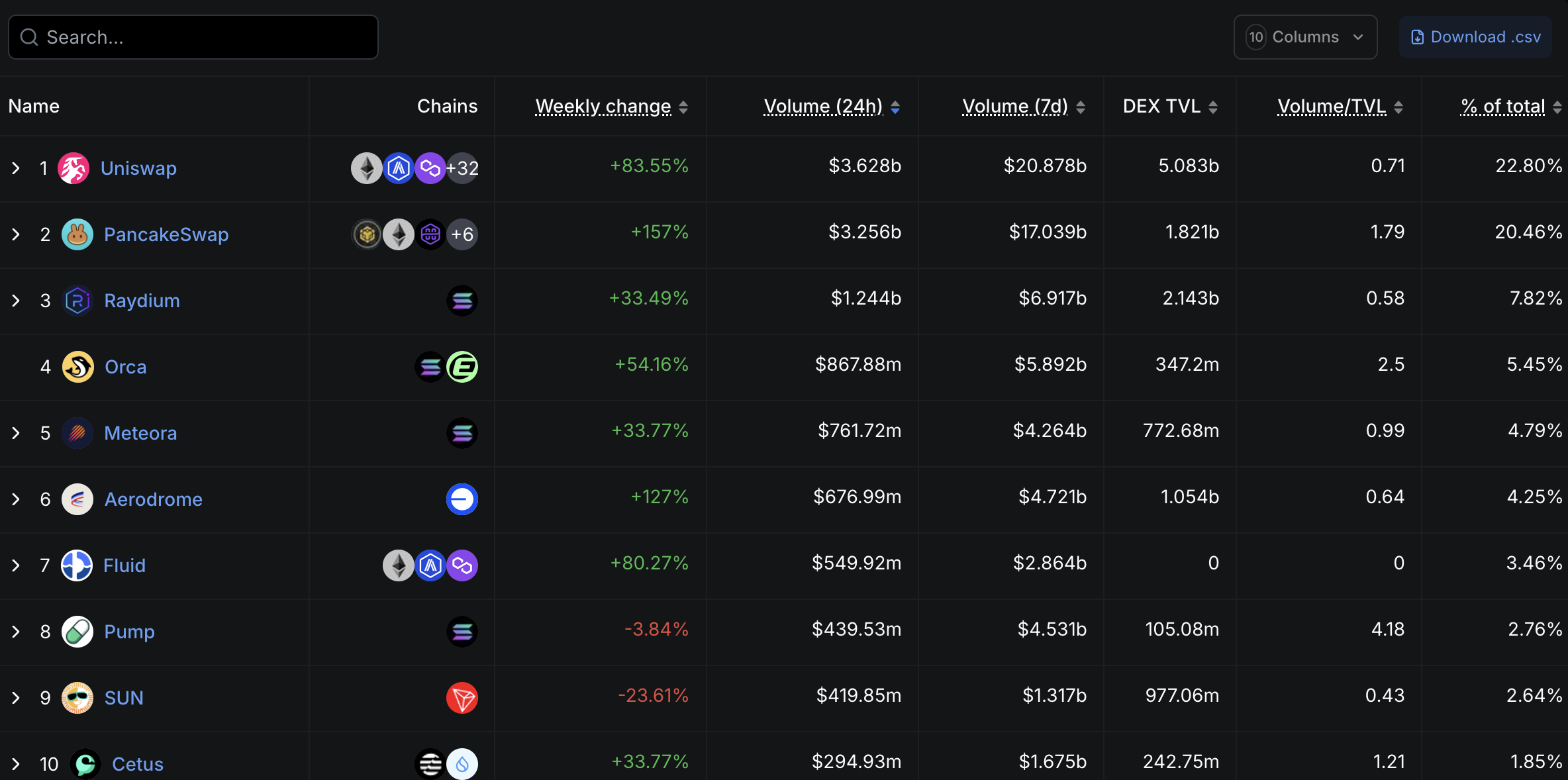

Uniswap Volume. Source: DefilLama

The New DeFi Boom Starting gains traction with Uniswap’s record-breaking $3 trillion in all-time trading volume, reported on May 12, 2025. Processing $3.6 billion in daily transactions, Uniswap commands 24% of global decentralized exchange (DEX) volume, reinforcing its leadership in DeFi trading. This milestone highlights the growing appeal of DEXs, which enable intermediary-free trades, reducing costs and enhancing transparency.

Uniswap’s success is tied to its automated market maker (AMM) model, which facilitates seamless token swaps. The platform’s ability to handle massive transaction volumes reflects a shift of capital from traditional finance to decentralized protocols, further fueled by ETH’s price surge and a crypto-friendly U.S. regulatory environment.

Read more: Decentralized Finance (DeFi): Mechanisms and Potential

Whale Movements and Market Dynamics

Whale activity on Aave and Uniswap underscores the New DeFi Boom Starting. The bullish purchases of WETH and WBTC signal confidence in Ethereum’s long-term growth, particularly as it sustains above $2,500. However, short-selling by some whales suggests caution, indicating potential volatility in DeFi markets. These contrasting strategies highlight the speculative nature of crypto, where large investors balance risk and reward.

Aave’s $25 billion TVL and Uniswap’s $3 trillion volume milestone demonstrate DeFi’s capacity to support complex investment strategies and high liquidity. Online discussions reflect optimism, with community members citing these records as evidence of DeFi’s resurgence. The influx of institutional interest, driven by relaxed U.S. policies, further bolsters this narrative.

Implications for DeFi’s Future

The New DeFi Boom Starting could redefine Ethereum’s role in global finance. Aave’s liquidity dominance and Uniswap’s trading volume highlight DeFi’s ability to rival traditional systems. The surge in WBTC and WETH transactions on Aave points to growing demand for decentralized lending, while Uniswap’s AMM model drives adoption of trustless trading.

Challenges remain, including market fluctuations and regulatory scrutiny. The divergent whale strategies—longs versus shorts—suggest short-term volatility, requiring investors to stay vigilant. However, Aave and Uniswap’s strong fundamentals, coupled with Ethereum’s rally, position DeFi for sustained growth, potentially attracting more institutional capital.

Conclusion

The New DeFi Boom Starting is propelled by Aave’s $25 billion TVL and Uniswap’s $3 trillion trading volume, fueled by ETH’s climb past $2,500. Active whale movements, from bullish WETH purchases to cautious shorting, reflect DeFi’s dynamic landscape. With blockchain technology advancing and regulatory tailwinds, Aave and Uniswap are leading a DeFi resurgence. While volatility persists, these milestones signal a maturing ecosystem, poised to reshape decentralized finance.